Recording Payment

- From the left navigation panel, click Matters.

- From the toolbar atop the Matters screen, click Action > Transaction Levy > Pay.

The Pay Transaction Levy screen opens, displaying the current quarter’s levies in a grid. - To change the levy criteria, to the right of the grid in the black panel, click the magnifying glass icon.

- On the Filter panel, apply your desired filters.

- Check the boxes beside the levies you want to pay.

- In the lower right corner, click Next.

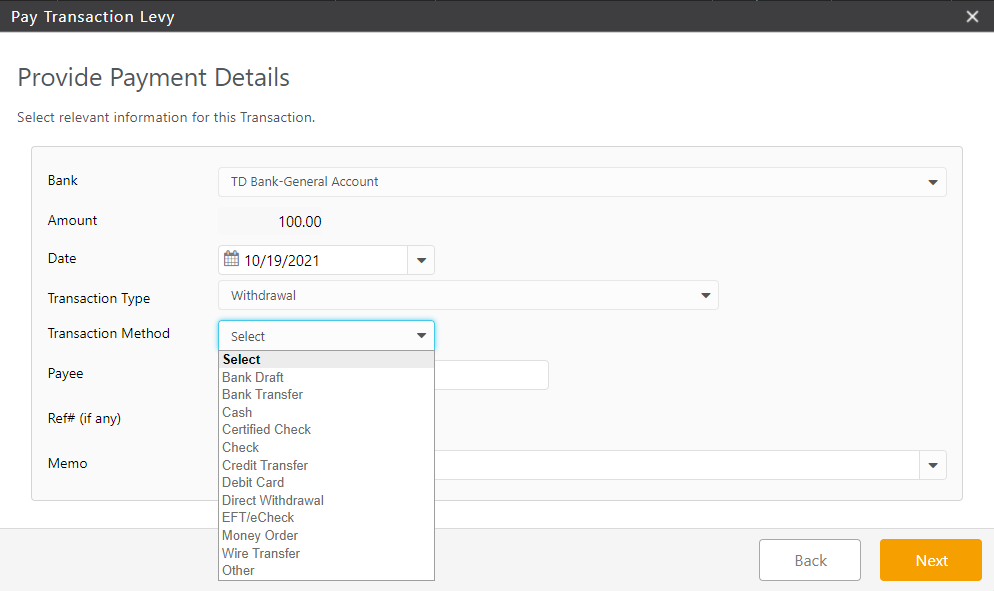

- On the Provide Payment Details screen, use the drop-down to complete the fields.

| Bank |

|

|---|---|

| Amount |

|

| Date |

|

| Transaction Type |

|

| Transaction Method |

|

| Payee |

|

| Ref # |

|

| Memo |

|

- In the lower right corner, click Next.

The system prompts you to review the payment summary. - In the lower right corner, click Pay.

The system marks the levies as paid and adds a transaction to the bank account you selected. If this was a cheque transaction, you can print your check.