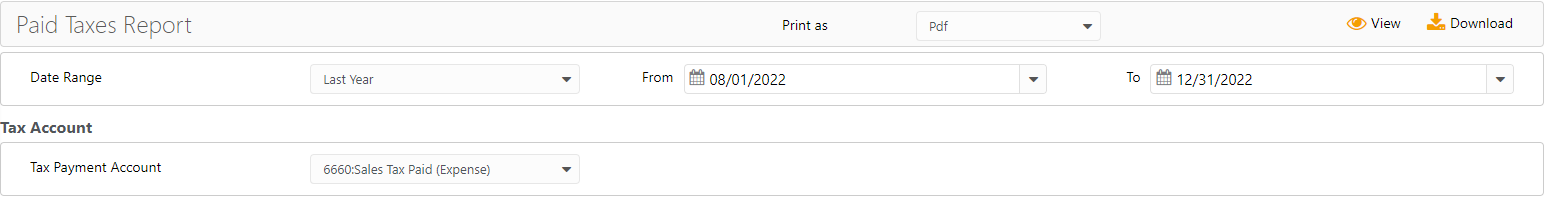

- CosmoLex users in US see the COA 6660: Sales Tax Paid (Expense)

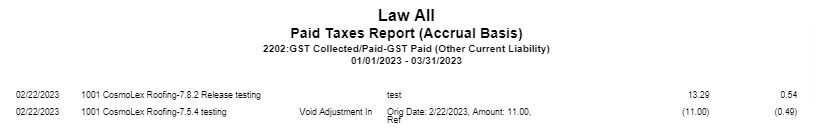

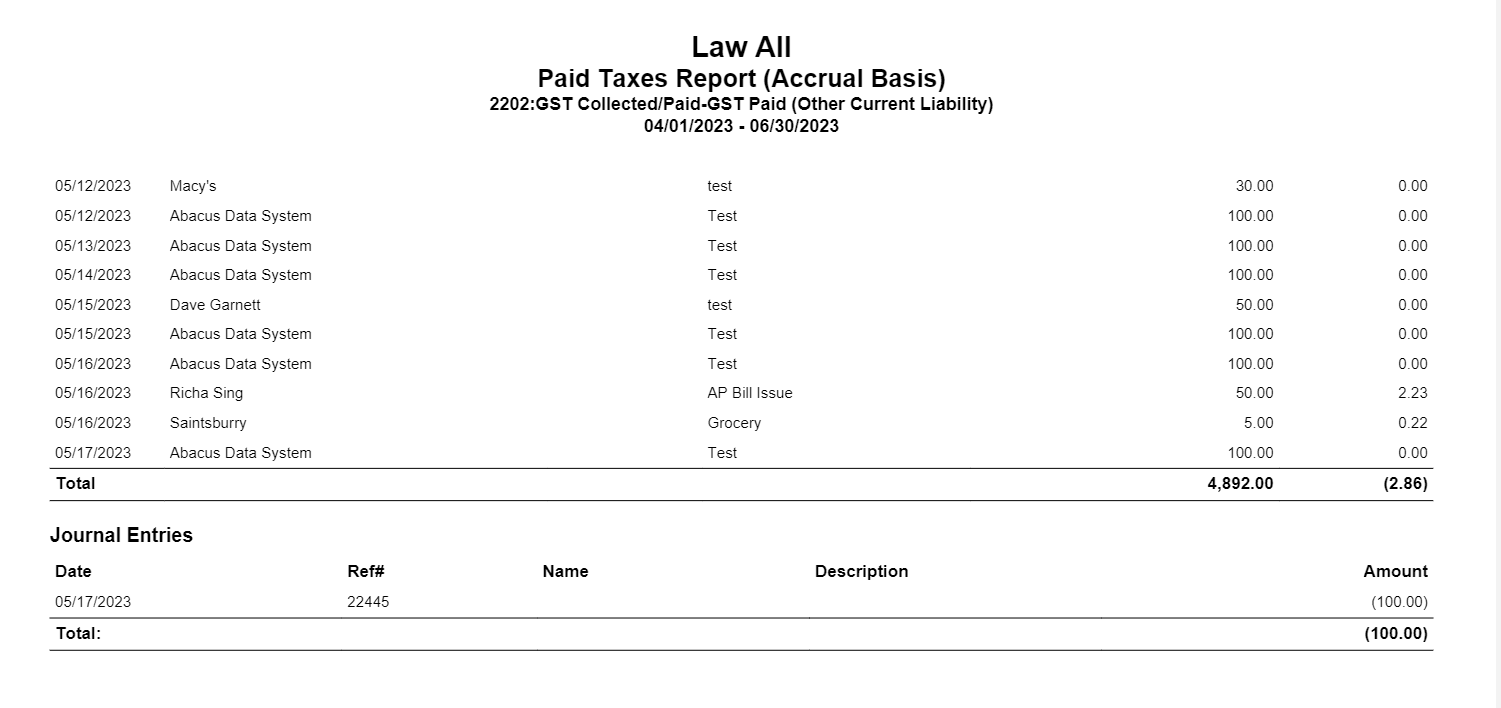

- In Canada, users see COA 2202: GST or HST Collected/Paid – GST Paid (Other Current Liability)

The Paid Taxes Report shows:

- Firm collected/paid taxes on vendor bills, the total for those bills, and the tax applied to them

- Void transactions along with void adjustment

- Journal entries at the end of the report

To access the report go to Reports > Tax Collection/Payments > Paid Taxes Report

Report Filters

- Date Range: The date in which the tax was recorded. Choose from last month, last quarter, last year, this month, this quarter, this year, or customize the date range to be covered in the report.

Tax Account

- Tax Payment Account: The account will default to your designated tax GL account.

View/Download

Click View to preview the report or to download, select the preferred format (Excel/PDF) and click Download.

Learn more about generating reports.