This report summarizes the revenues, costs, and expenses incurred during a specific period of time – usually a fiscal quarter or year. These records provide information that shows the ability of a company to generate profit by increasing revenue and reducing costs.

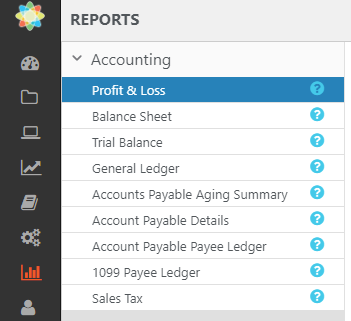

To access this report, go to Reports > Accounting > Profit & Loss

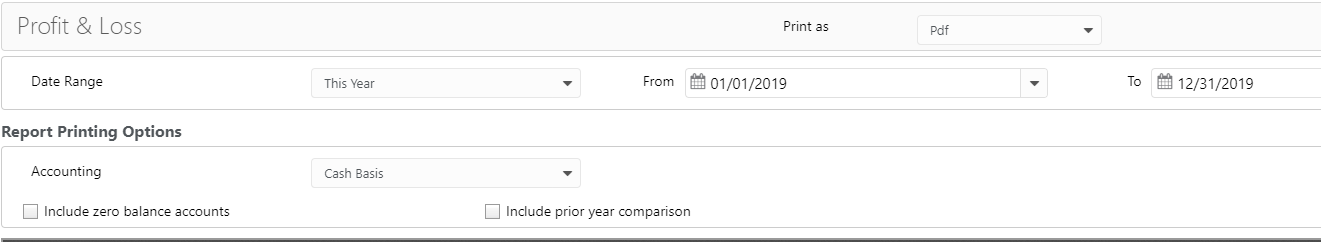

Report Filters

- Date Range: The date range options you have are All Dates, Last Month, Last Year, This Month, This Year. You can override the date range via the from/to boxes to the right

- Accounting: You can generate the Profit & Loss Report for two types of accounting: cash basis or accrual basis.

Report Printing Options

- Include zero balance accounts: Checking this option will include those income and expense accounts which have 0.00 balances. This is unchecked by default

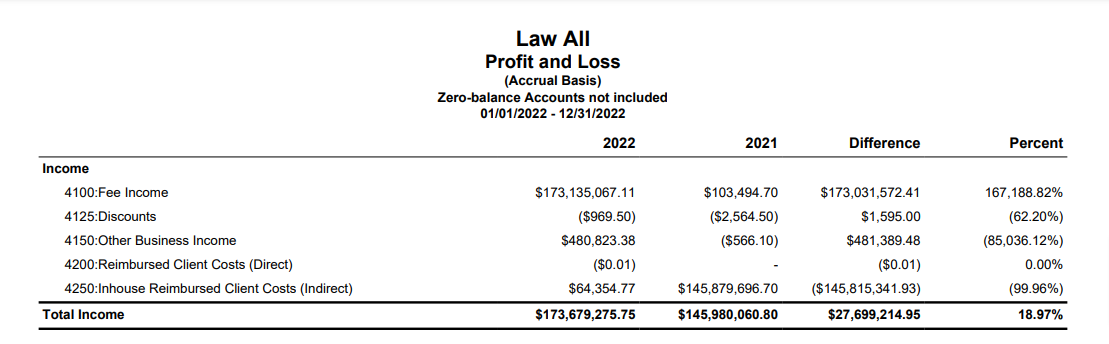

- Include prior year comparison: Checking this option will show amounts from the prior year as well and dollar and percentage difference. This is unchecked by default.

View/Download

Click View to preview the report or to download, select the preferred format (Excel/pdf) and click Download.

Learn more about generating reports.

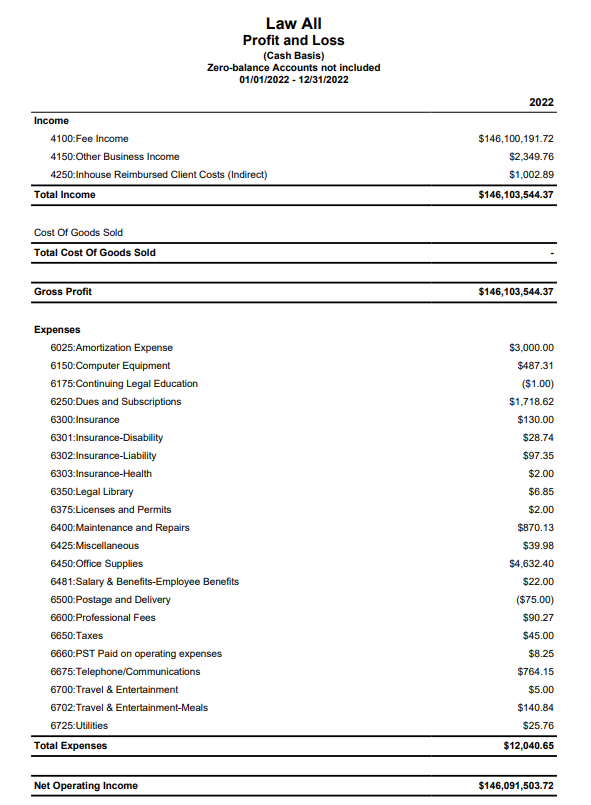

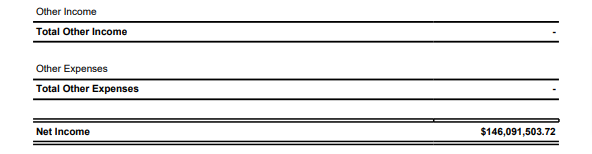

Sample Report

Prior Year Comparison

P & L Cash Basis