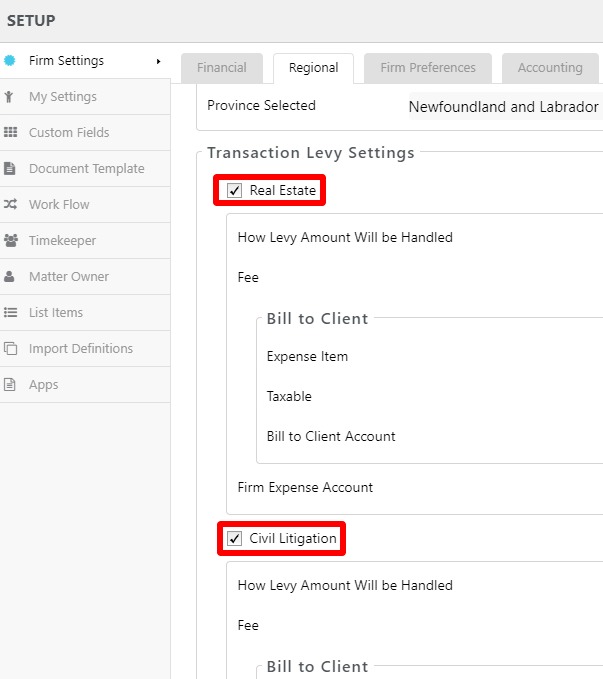

Under Setup > Firm Settings > Regional, you can review or change the default settings for handling Transaction Levies.

Levy Settings

To set up your transaction levy settings:

- Enable your province-specific settings.

- The Transaction Levy Settings appear under Regional Settings once you’ve selected the province.

- Within the Transaction Levy Settings section, the Real Estate and Civil Litigation sections’ boxes are checked by default for Ontario, Newfoundland & Labrador. Uncheck whichever may not apply.

- For Alberta, Civil Litigation is the only option.

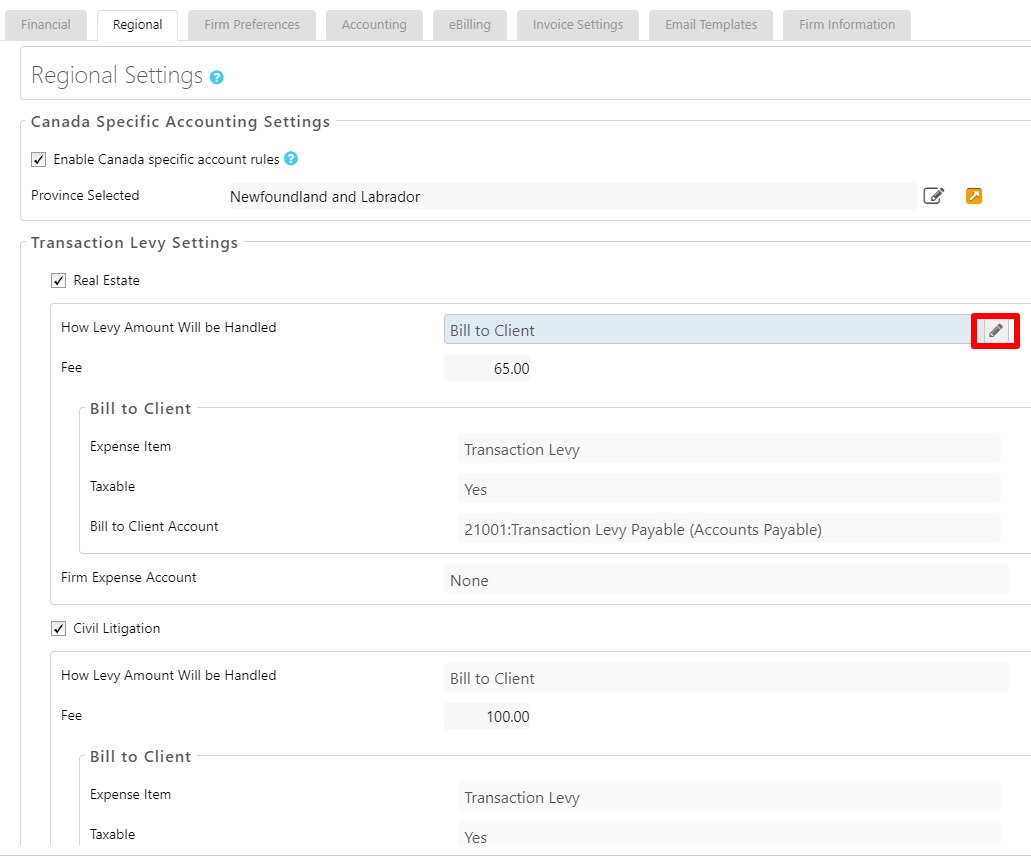

- To change a levy field setting, either click within the field or hover over the far right of the field and click the pencil icon that appears, as in this image. The field will then switch to edit mode.

- Depending on the field, you can either use the drop-down menu to click an option or enter a value. The table below provides further context for each field.

- Click the checkmark to the right of the field to save your entry or click X to cancel it.

| How Levy Amount Will be Handled |

|

|---|---|

| Fee |

|

| Bill to Client |

|

| Firm Expense Account |

|

| Report Information |

|

Learn more about our Transaction Levy Feature