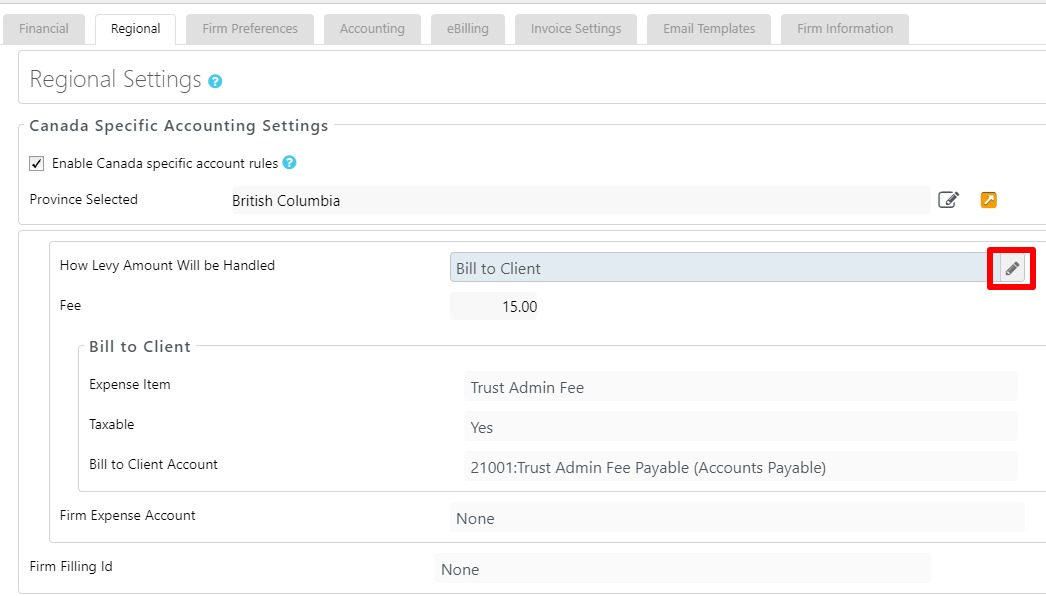

Under Setup > Firm Settings > Regional, you can review or change the default settings for handling Trust Admin Fees (TAFs).

Review TAF Settings

-

The TAF settings will appear under Regional Settings once you’ve selected British Columbia as your province.

- To change a TAF field setting, either click within the field to edit it, or hover over its right corner and click the pencil icon that appears, as in this image. The field switches to edit mode.

- Depending on the field, you can either use the drop-down menu to click an option or enter a value. The table below provides further context for each field.

- Click the checkmark to the right of the field to save your entry or click X to cancel it.

| How Trust Admin Fee Amount Will be Handled |

|

|---|---|

| Fee |

|

| Bill to Client |

|

| Firm Expense Account |

|

| Firm Filing Id |

|

Learn more about our Trust Admin Fee feature.