You can record the outside income you receive for activities such as mediation and speaking events.

Record Non-Fee Income

To record non-fee income:

- From the left navigation panel, click Accounting.

- From the Accounting left navigation, click Bank.

- On the Bank screen, either double-click the operating bank account, or single-click it, and then from the toolbar, click Details.

- Atop the Bank’s left navigation, click Transaction.

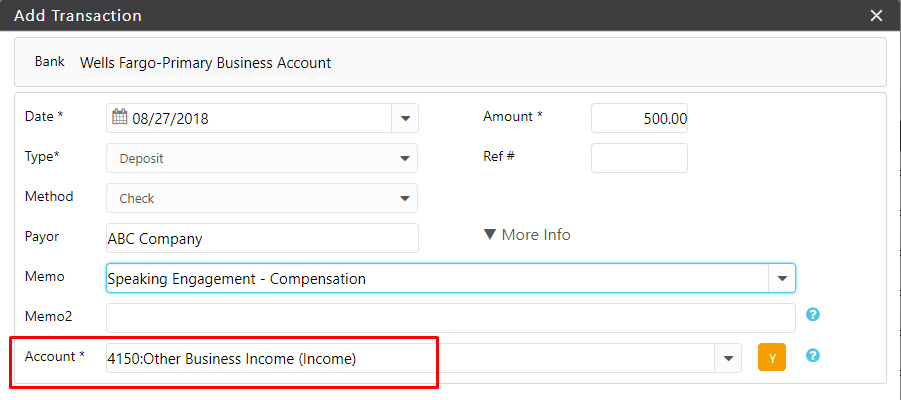

- From the toolbar atop the Transaction screen, click Add > Deposit.

- On the Add Transaction screen, from the Date field’s drop-down, click the date you are voiding the transaction.

- In the Amount field, enter the income amount.

- From the Type field’s drop-down, click Deposit.

- In the Payee or Payor field, enter the payor’s name.

- In the Memo field, enter the income type.

- In the Memo2 field, enter an internal reference note, desired.

- From the Account field’s drop-down, 4150: Other Business Income (Income).

This designated non-fee income account groups the income “above the line” on your Profit and Loss and includes it in the firm’s income or loss calculation. - In the lower right corner, click Save.

The system saves your non-fee income transaction.