This report contains fees collected by each timekeeper in your firm and computes the earned fee for each timekeeper in a given date range. This report can be used for a variety of needs: Productivity measurement; facilitating apportion fee allocation to timekeepers by work/collection activities; distribution mechanism for improved cash flow for outside counsel.

If you attempt to do these calculations manually, you are likely to encounter the following challenges:

- If the invoice includes a discount, it would need to be allocated to individual timekeepers for accurate calculations.

- Once the invoice is paid, the allocation will begin from liabilities and costs. Then, fee amounts would be considered paid. This gets very complicated if invoices are paid in multiple payments over a period of time.

- The proportional allocation of discounts and fee payment is cumbersome and error-prone.

CosmoLex’s “Collection by Timekeeper” report addresses all these concerns and provides you with a one-click solution to this complex set of calculations.

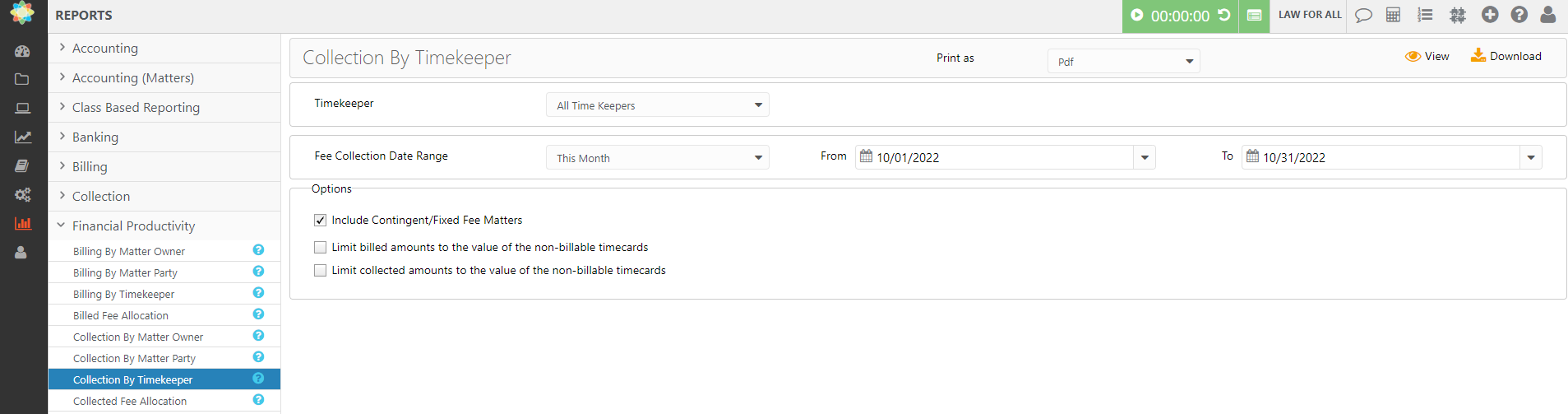

To access the report, go to Reports > Financial Productivity > Collection by Timekeeper

Report Filters

- Timekeeper: Choose all timekeepers or a specific timekeeper

- Date Range: The date range options you have are All Dates, Last Month, Last Year, This Month, and This Year.

- Options

- Include Contingent/Fixed Fee Matters: When checked, the report includes Contingent/Fixed Fees based on each timekeeper’s portion of the non-billable timecard value associated with the invoice.

You may override the proportional fee calculation by selecting one or more of the following:

- Include Contingent/Fixed Fee Matters: When checked, the report includes Contingent/Fixed Fees based on each timekeeper’s portion of the non-billable timecard value associated with the invoice.

-

- Limit billed amounts to the value of the non-billable timecards: When checked, the timekeeper’s billed fees cannot exceed the total value of the timekeeper’s non-billable timecards associated with the invoice.

-

- Limit collected amounts to the value of the non-billable timecards: When checked, the timekeeper’s collected fees cannot exceed the total value of the timekeeper’s non-billable timecards associated with the invoice.

View/Download

Click View to preview the report or to download, select the preferred format (Excel/pdf) and click Download.

Learn more about generating reports.

Calculation Notes

- Only invoices that have payment applied in the selected date range are shown. All calculations are done when payment is actually applied to the invoice. For example, if you received a retainer in March but applied it in April, the corresponding invoice will show it in the April report.

- If any discount was provided in the invoice, that discount is allocated to timekeepers. proportionally. This effectively reduces “Billed Fee” of individual timekeepers in proportion to the discount provided.

- The summary section lists totals for individual Timekeepers as well as Matter Owners.

Calculation Example

|

Invoice Date |

Invoice # |

Timekeeper A Billed Amount |

Timekeeper B Billed Amount |

Expense Cards |

Invoice Discount |

Total Invoice Amount |

|

07/01/2019 |

101 |

$200 |

$100 |

$50 |

$30 |

$320 |

Timekeeper A Billed Fee (including Discount Allocation) = $180 ($200 – 10% discount allocation)

Timekeeper B Billed Fee (including Discount Allocation) = $90 ($100 – 10% discount allocation)

Total Billed Fee (including Discount Allocation) = $270

|

Payment Date |

Amount |

Total Collected Fees |

A’s Portion of Collected Fee |

B’s Portion of Collected Fee |

|

08/01/2019 |

$160 |

$110* |

= 110 x 180/270 => $73.33 |

= 110 x 90/270 => $36.67 |

|

09/01/2019 |

$160 |

$160 |

= 160 x 180/270 => 106.67 |

= 160 x 90/270 => 53.33 |

* First $50 is allocated to the Expense reimbursements.

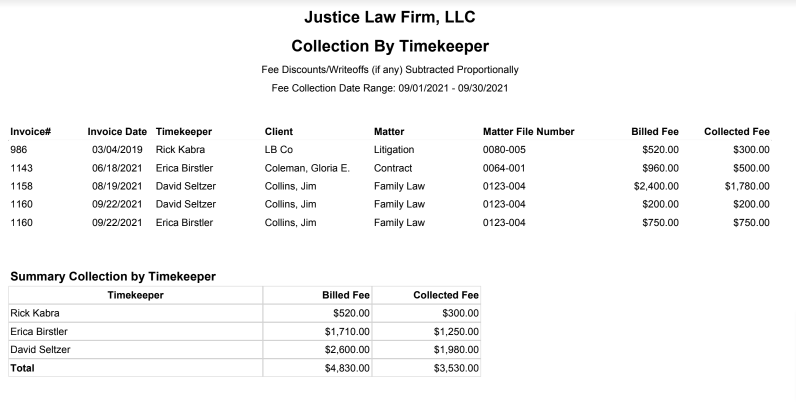

Sample Report