You can use the deposit slip feature for reconciliation and record-keeping purposes.

Law firms use this feature:

- When creating a deposit slip to take to the bank.

- When batching payment transactions or trust deposit transactions to ensure the total deposit amount displayed on the reconciliation screen matches the deposit amount displayed on the bank statement.

Create a Deposit Slip

To create a deposit slip:

- From the left navigation panel, click Accounting.

- Atop the Accounting gray left navigation, click Bank.

- On the Bank screen, double-click the bank, or single-click it to highlight it, and then from the toolbar, click Details.

- From the Banks left navigation, click Deposit Slips.

- From the toolbar atop the Deposit Slips screen, click Add.

- On the Add Deposit Slips screen, from the Deposit Date field’s drop-down, click the deposit date.

- In the Ref # field, enter a reference number if desired.

- Under the Options section, click the radio button to combine the applicable payment types: Combine Check/Wire/ACH Payments, Combine Check Payments Only, or Combine Integrated Payments (Batch).

- Select the deposits you want to combine.

Beneath and to the far right of the details window, the Total Amount field updates with each payment you select. - In the lower right corner, click Save.

The system saves your deposit slip. When you reconcile your account, your deposit amount will match your deposit slip total.

Print Deposit Slip

- From the left navigation panel, click Accounting.

- Atop the Accounting gray left navigation, click Bank.

- On the Bank screen, double-click the bank, or single-click it to highlight it, and then from the toolbar, click Details.

- From the Banks left navigation, click Deposit Slips.

- Single-click your deposit slip to highlight it.

- From the toolbar, click Action > Print Deposit Slip.

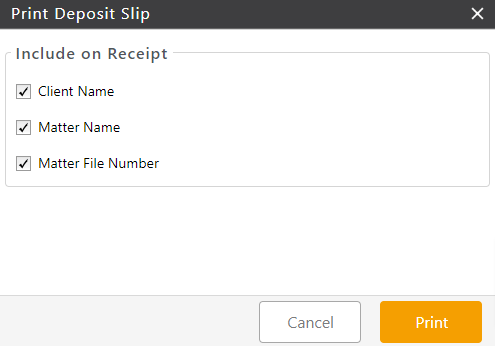

- On the Print Deposit Slip pane, uncheck the boxes beside the information you do not want to include in your deposit slip.

- In the lower right corner, click Print.

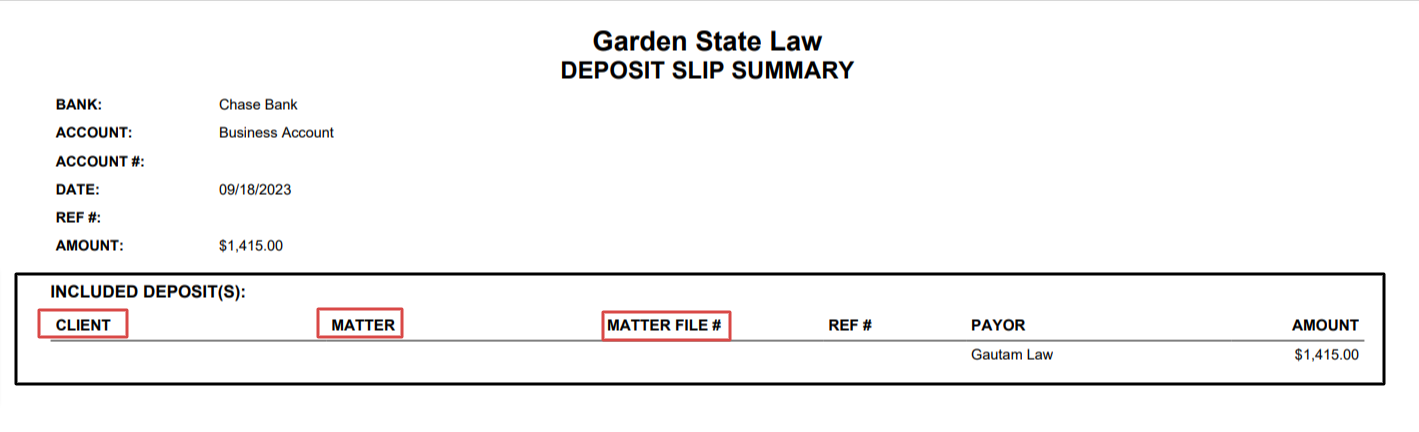

The system downloads the deposit slip in PDF Format to your designated location.

Important to Know

- For credit card batching, only those transactions processed through our payment processing integrations will display.

- Credit card transactions do not have to have the same date, as in some situations a charge entered today may not be processed until the next business day.

- The deposit slip will not correct trust retainers received via LawPay or CosmoLexPay with differing dates.

- Voids display in this list as sometimes they occur days after the original transaction.