You may encounter expense items that must be charged a different rate than the firm’s default.

When entering an expense, you can change the tax defaults as well as override the tax rate.

Change Default Tax Setting

If an expense item’s status always differs from the firm’s default, the best practice is to change the expense item’s default status.

To change an expense item’s default tax setting:

- From the left navigation panel, click Setup.

- From the Setup left navigation, click List Items.

- From the tabs atop the List Items screen, click Expense.

- On the Expense screen, take the appropriate action:

- Add Item

- From the toolbar, click Add.

The Add Expense screen opens.

- From the toolbar, click Add.

- Edit Item

- Either double-click the expense item, or single-click it to highlight it, then from the toolbar, click Edit.

The Edit Expense screen opens.

- Either double-click the expense item, or single-click it to highlight it, then from the toolbar, click Edit.

- Add Item

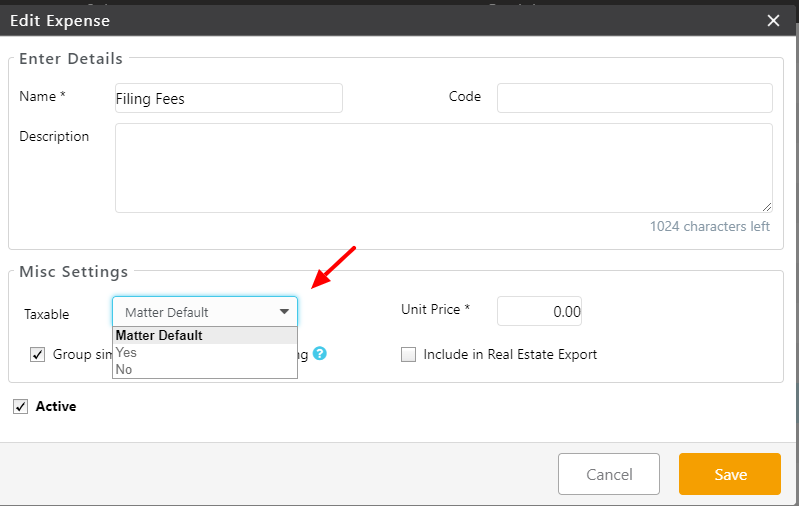

- In the Misc Settings section’s Taxable field drop-down, click the appropriate default setting:

Matter Default Item will mirror the associated matter’s taxable status. Yes Item will always be taxable No Item will always be non-taxable - Click Save.

The taxable status updates.

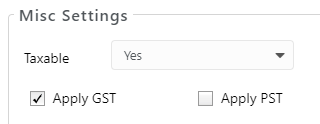

For Multi-Tax Provinces

When you set the Taxable field to Yes, you control which tax type applies to the expense.

For example, if you have a disbursement to which PST does not apply, you can uncheck Apply PST, then click Save.