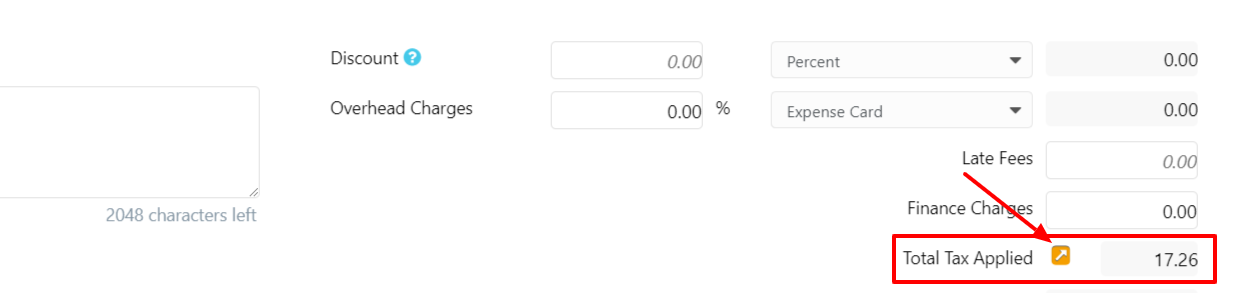

When you create or edit an invoice, the summary section’s Total Tax Applied field displays the sum of taxes.

For a breakdown of that total, click the orange details icon.

In this example, the breakdown includes the taxes charged on fees, costs, and pass-through items from a payable.

Taxes on Partial Payments

Partial payments are applied according to this approved accounting hierarchy:

- Firm/collected taxes (on fees/expenses)

- Vendor collected taxes

- Advanced client cost reimbursements (hard costs)

- Cost Recovery (soft costs)

- Fees

View Invoice Payment Allocation Details

From Matters

To view an invoice’s payment allocation detail, including partial payments:

- From the left navigation panel, click Matters.

- On the Matters screen, double-click the matter, or single-click it, then from the toolbar, click Details.

- From the Matters left navigation, click Billing.

- From the tabs atop the Billing screen, click Invoices.

- On the Invoices screen, locate the invoice for which you want to view payment allocation details.

- To the far right of its row, click the orange details icon.

The Invoice Details screen opens.Invoice Components Original invoice fees and costs Applied Payments Payments applied to the invoice Payment Allocation How applied payments were allocated on the GL

- When finished, click Close.

From Activities

- From the left navigation panel, click Activities.

- From the Activities left navigation, click Invoices.

- On the Invoices screen, locate the invoice for which you want to view payment allocation details.

- To the far right of its row, click the orange details icon.

The Invoice Details screen opens.Invoice Components Original invoice fees and costs Applied Payments Payments applied to the invoice Payment Allocation How applied payments were allocated on the GL

- When finished, click Close.